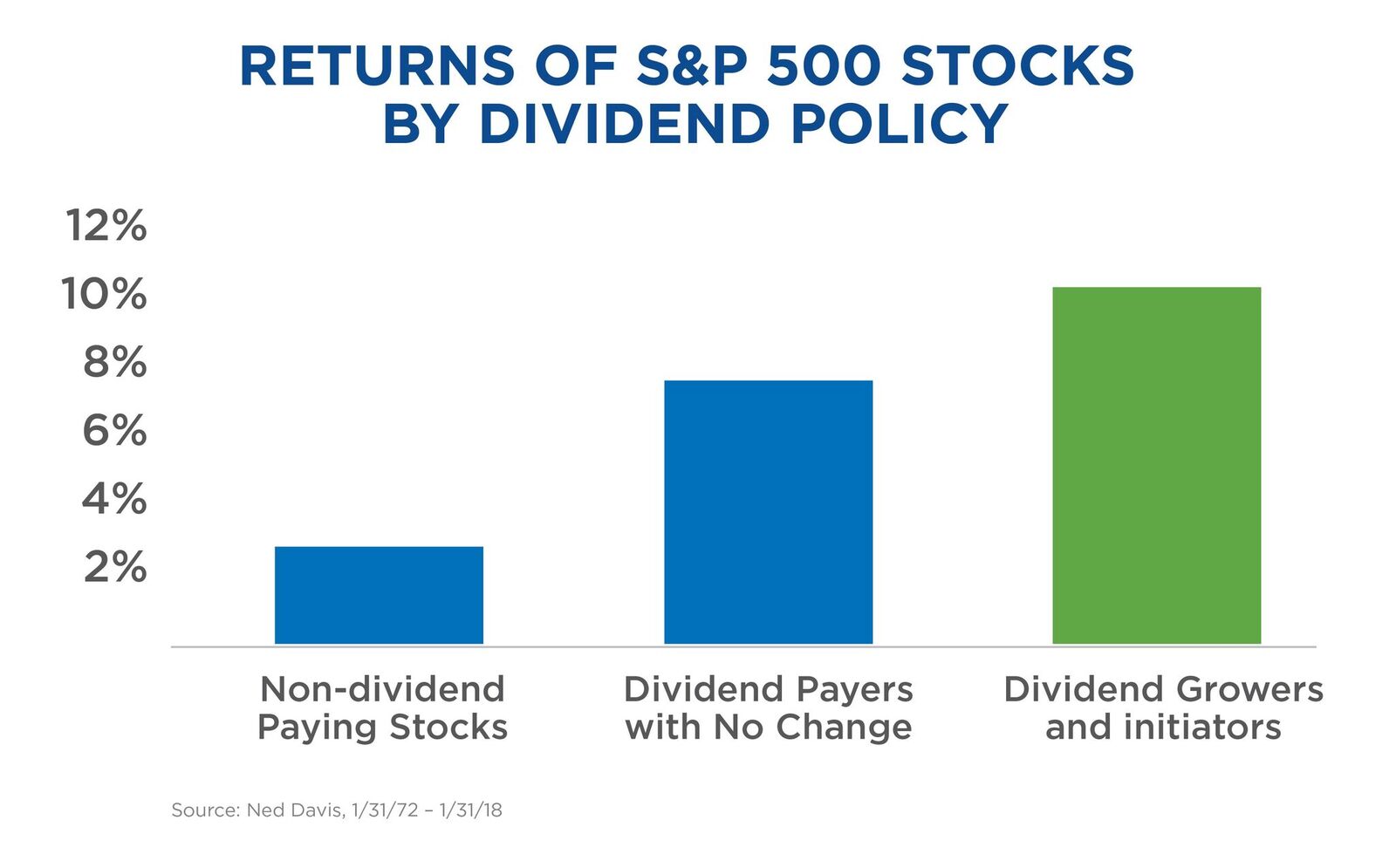

Dividend growth investing has a long track record of success. There is objective evidence that investing in companies with growing dividend streams offers the potential for attractive long-term returns. After analyzing 46 years of data from 1972 to 2018, Ned Davis Research observed that S&P stocks that exhibit consistent growth in dividends have outperformed other categories of stocks. Dividend growers and initiators have experienced better returns over the long-term.

Steady dividends combined with increases in those dividends have the potential to create meaningful compounded returns over time. When stocks pay a cash dividend, it enables you to reinvest that cash in more stock. This newly purchased stock then pays the same consistent, growing dividend, each time enabling you to buy more stock that also pays dividends.

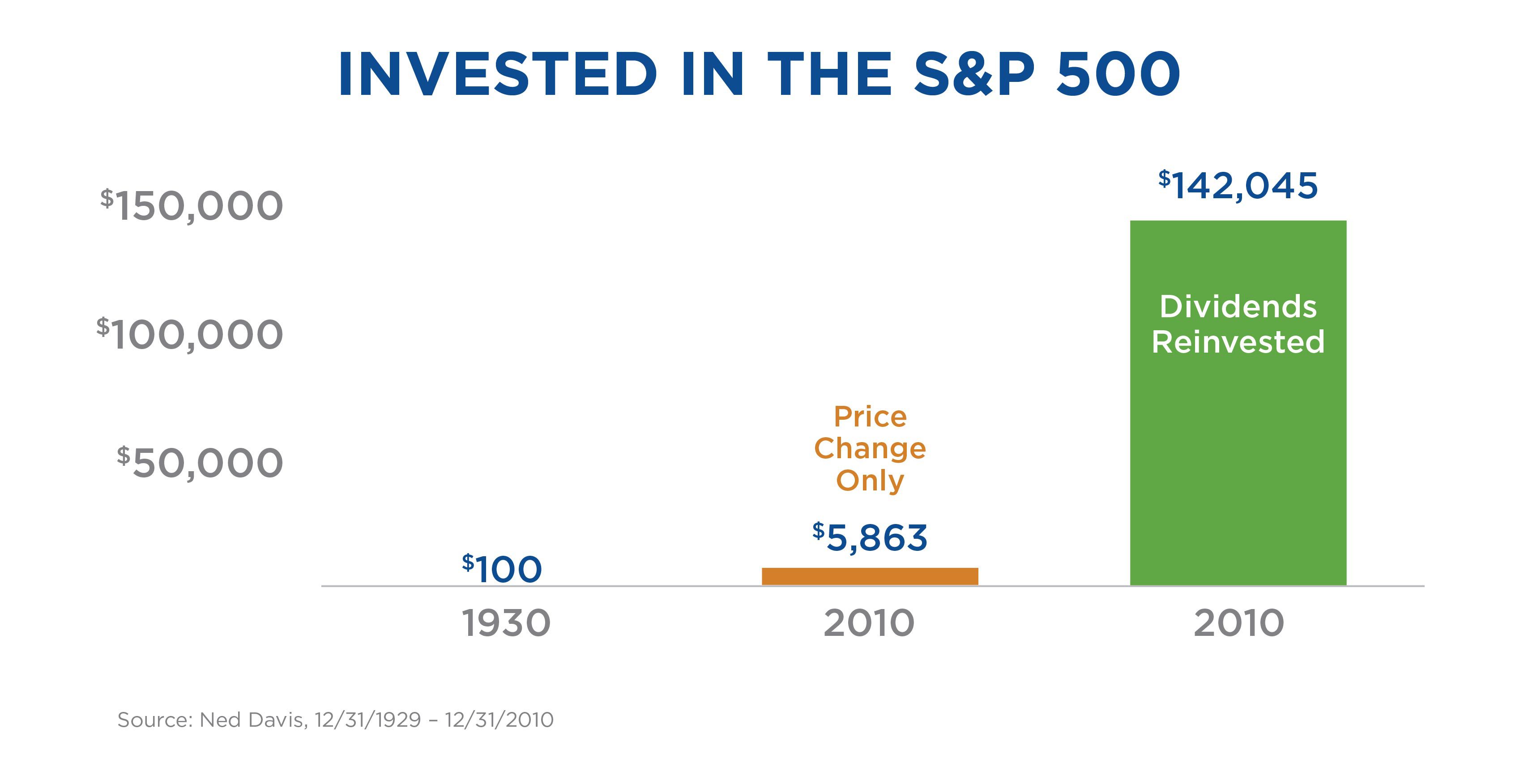

In one study, Ned Davis Research observed that $100 invested and benefiting only from price change turned into $5,863 over an 80 year period. When adding compound growth from reinvesting dividends, that $100 grew to $142,045. This shows just how powerful the dividend compounding effect can be on your investment!

A dividend growth investment strategy has the potential to provide consistent and growing income regardless of stock market performance. This provides an important source of cash available for reinvestment. In a down market, cash from these consistent dividends enable purchasing stocks at a better cost basis, thus enhancing potential returns over time.

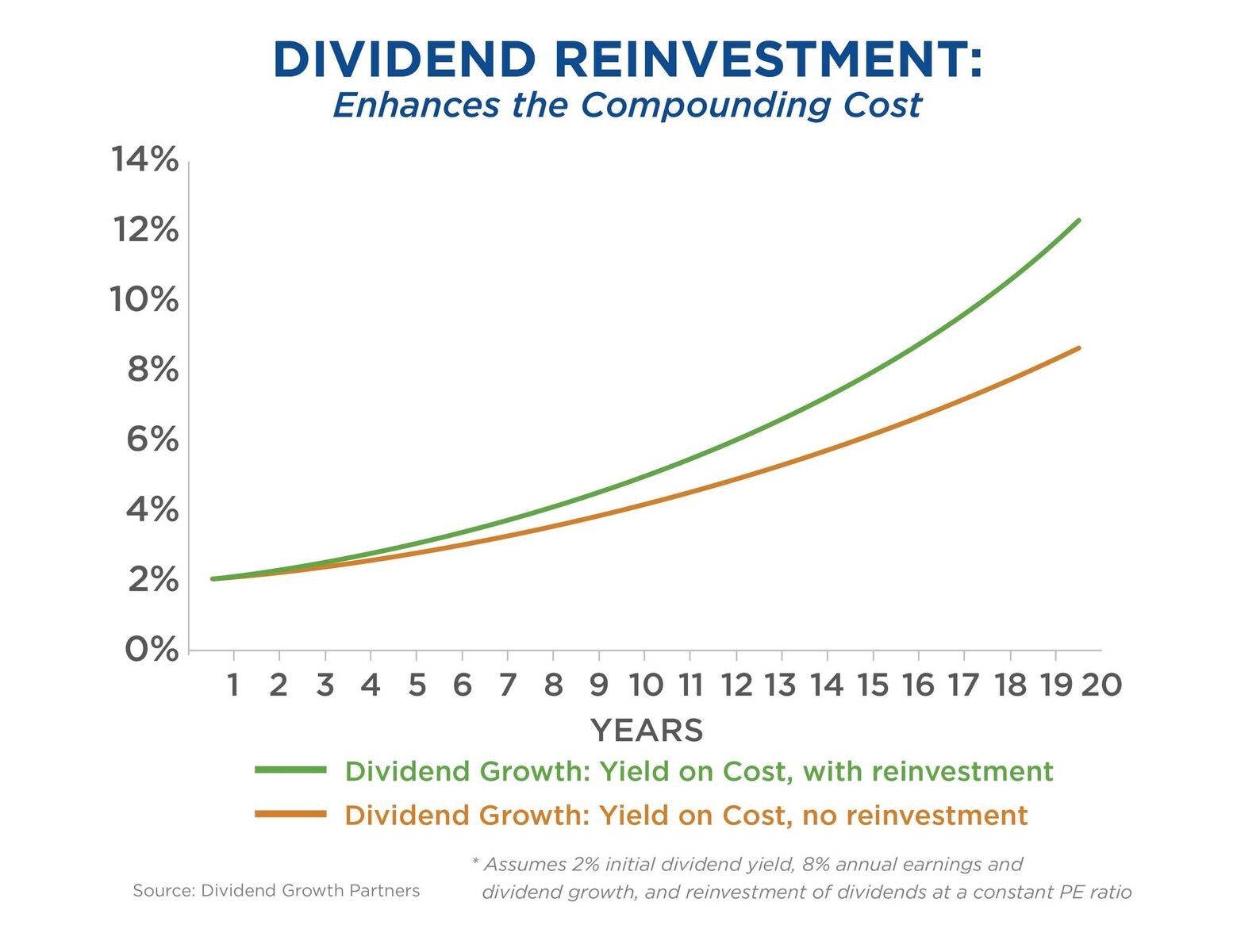

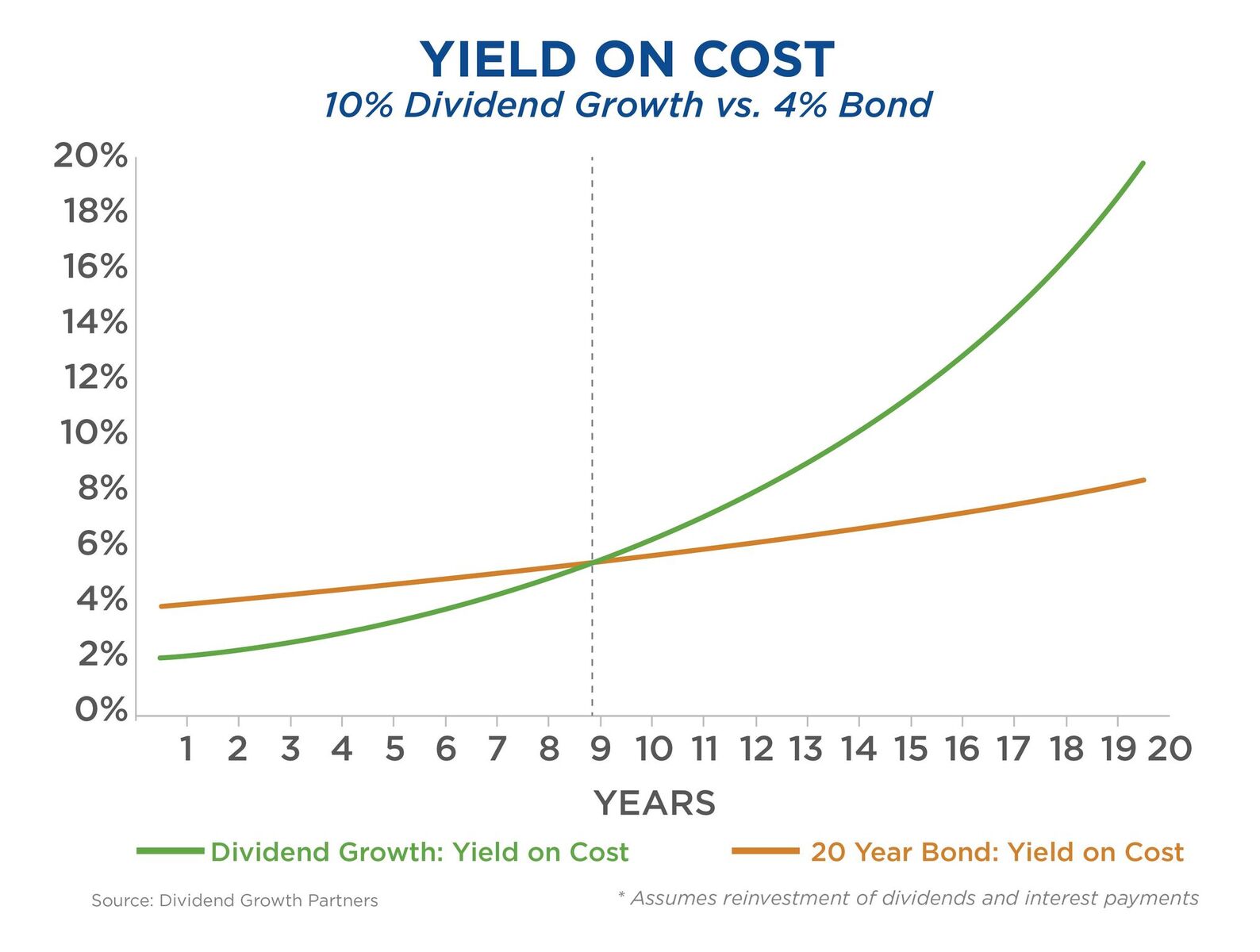

A dividend growth strategy magnifies your investment over the long-term, efficiently generating return for the dollars you’ve invested. This is perhaps best seen when considering an investment’s yield on cost (the current yield dividend by the original purchase price). Growing dividends combined with the compounding effect from dividend reinvestment results in a greater and greater return over time for a given initial investment.

A dividend growth strategy magnifies your investment over the long-term, efficiently generating return for the dollars you’ve invested. This is perhaps best seen when considering an investment’s yield on cost (the current yield dividend by the original purchase price). Growing dividends combined with the compounding effect from dividend reinvestment results in a greater and greater return over time for a given initial investment.A company that pays a growing dividend often indicates that it is a quality business. The ability to consistently pay and grow a dividend provides insight into the fundamental strength of an organization, often revealing a long-term sustainable business model that produces cash flow throughout the business cycle. It can also indicate that a company is thoughtful about its capital allocation.

The dividend can be a meaningful contributor to an investor’s total return, especially through low growth environments. There may be points in time when the market is down, but a dividend growth investor can rely on dividends as a consistent source of current (and often growing) income. Regardless of market movements, a dividend growth strategy provides current income that an investor can either reinvest or take as a cash payment.

Even more than current income, a dividend growth strategy looks to increase income over time. Investing in companies that regularly increase their dividends results in an income stream that is not only consistent but growing as well. For an investor, this provides flexibility in use of the dividends. A dividend growth investor can vary how they utilize dividends throughout the different stages of their lives.

Growing dividends help investors to maintain purchasing power during an inflationary period. As prices rise, having an income stream that grows gives investors a powerful tool against the negative impacts of inflation.